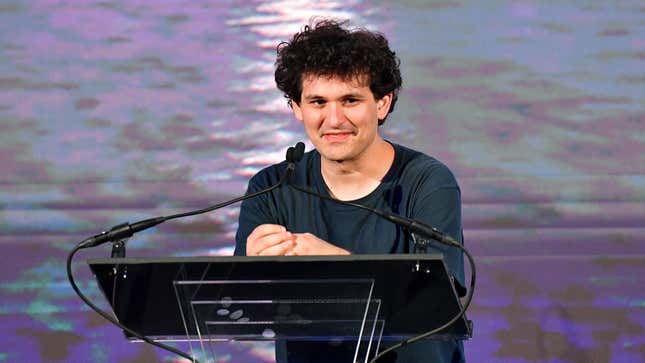

Texas regulators are investigating crypto exchange FTX and its spend-thrift founder Sam Bankman-Fried to determine whether or not they are offering unregistered securities products. The investigation, first reported by Barrons, is reportedly being carried out by the Texas State Securities Board which revealed the probe in a filing related to the bankruptcy case of crypto broker Voyager Digital.

“I am aware that FTX Trading…may be offering unregistered securities in the form of yield-bearing accounts to residents of the United States,” TSSB enforcement director Joseph Jason Rotunda wrote in the filing. Rotunda said those products appear similar to “yield-bearing depository accounts,” previously offered by Voyager.

The issue here is that Texas reportedly requires firms that offer these types of financial services to register with local regulators. In this case, that’s the Texas State Securities Board. It’s worth noting that The Lone Star State, along with dozens of others and the Securities and Exchange Commission have all launched investigations into Voyager’s similar interest paying services.

Rotunda claims he was able to create an FTX account with his personal information and an Austin, Texas address which he then used to purchase some Ethereum. When he moved his Ethereum to an FTX Wallet via the FTX Trading App, the regulator claims the app told him he was eligible to earn yields on his deposit. Rotunda claims his yields were estimated at 8% APR.

“Based upon my earning of yield and an ongoing investigation by the Enforcement Division of the Texas State Securities Board, the yield program appears to be an investment contract, evidence of indebtedness and note, and as such appears to be regulated as a security in Texas,” Rotunda wrote. “Further investigation is necessary to conclude whether FTX Trading, FTX US and others are violating the Securities Act through the acts and practices described in this declaration.”

FTX did not immediately respond to Gizmodo’s request for comment, however, a spokesperson for the company told Barron’s they have an “active application” for the license and believe they, “are operating fully within the bounds of what we can do in the interim.”

Earlier this year, Bankman-Fried told Forbes in an interview he was investing hundreds of millions of dollars into struggling exchanges to keep them afloat following a horrific summer that left major crypto companies unable to pay back their users. Last month, FTX reportedly paid $1.42 billion at auction to acquire bankrupt Voyager’s assets. Prior to that the company revealed it had a 7.6% stake in Robinhood whose cryptocurrency wing recently laid off 23% of its workforce

The Texas investigation will likely bring renewed scrutiny to CEO Bankman-Fried who recently walked back claims he would spend around $1 billion in political donations ahead of the 2024 U.S. presidential election. That, Decrypt notes, would have made Bankman-Fried the single largest donor in the last elections by a long shot. Bankman-Fried has reportedly already spent $40 million into PACs and campaign donations during the current midterm cycle, but now says that billion figure was a bit ambitious.

“That was a dumb quote,” Bankman-Fried said in a Politico interview this week. “I think my messaging was sloppy and inconsistent in some cases.”